Creating generational wealth isn’t just about amassing a fortune in your lifetime – it’s about securing financial stability and growth for future generations. Whether you’re aiming to leave a lasting legacy or provide a financial head start for your descendants, building generational wealth requires smart planning, strategic investments, and a deep understanding of the tools available. Looking at how some of the world’s wealthiest families have succeeded in passing down their fortunes can offer valuable insights.

What is Generational Wealth?

Generational wealth refers to assets that are passed down from one generation to another, ensuring that each subsequent generation has a strong financial foundation. This wealth can include real estate, businesses, investments, trusts, and other valuable assets. The goal is to create a sustainable financial ecosystem that can support your family for years, if not centuries.

Lessons from the Rich and Famous

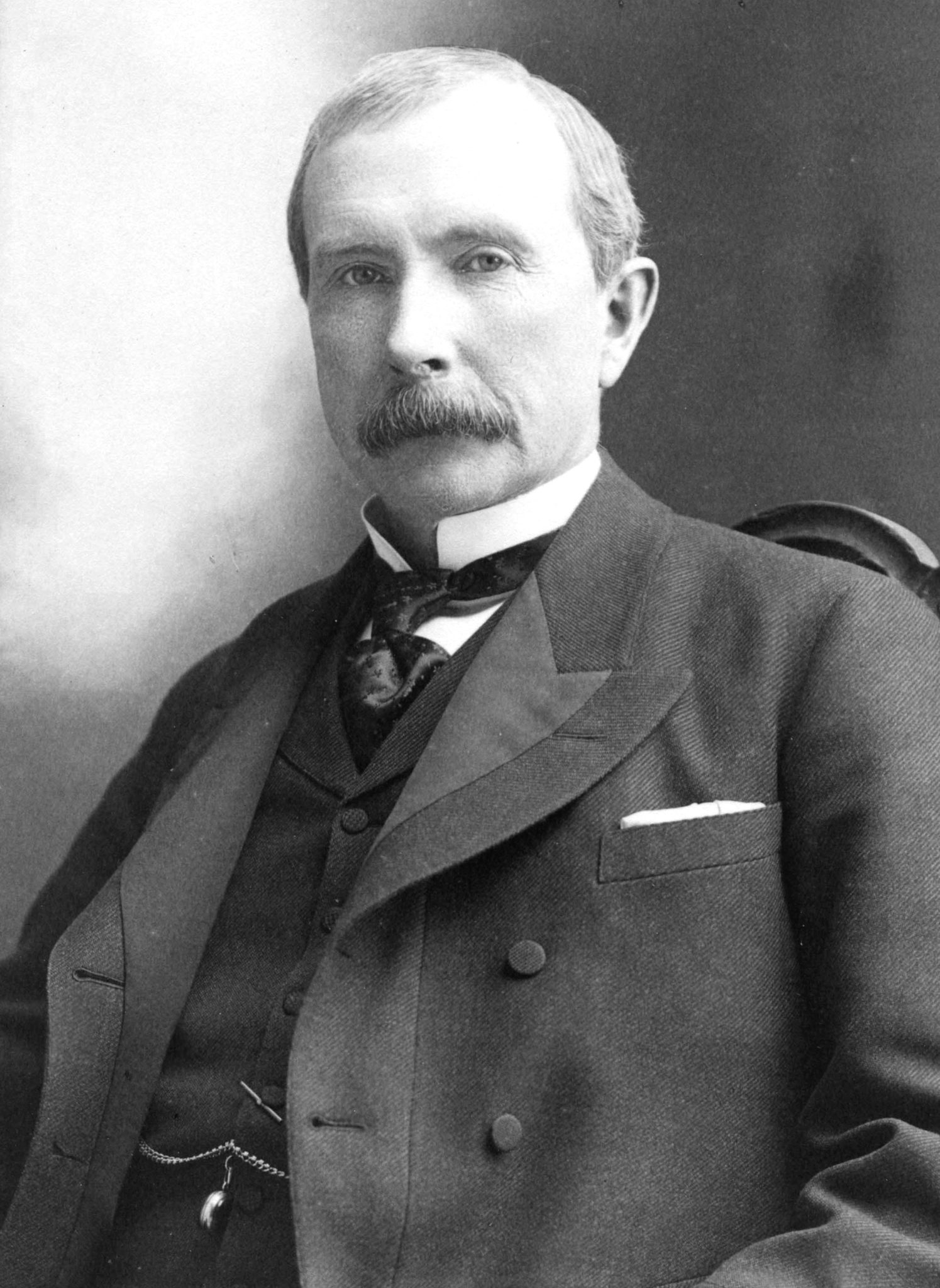

1. The Rockefeller Family: Trusts and Long-Term Planning

John D. Rockefeller, one of the wealthiest individuals in history, is a prime example of how strategic planning can preserve wealth across generations. The Rockefeller family established trusts that controlled much of their wealth, ensuring that the assets were managed prudently and that the family’s financial legacy was protected from market volatility, taxes, and legal disputes. The Rockefeller trust model continues to serve as a blueprint for those seeking to build and protect generational wealth.

Key Takeaway: Establishing well-structured trusts is crucial. Trusts can provide ongoing management of assets, reduce tax burdens, and protect wealth from creditors and legal challenges.

1. The Rockefeller Family: Trusts and Long-Term Planning

John D. Rockefeller, one of the wealthiest individuals in history, is a prime example of how strategic planning can preserve wealth across generations. The Rockefeller family established trusts that controlled much of their wealth, ensuring that the assets were managed prudently and that the family’s financial legacy was protected from market volatility, taxes, and legal disputes. The Rockefeller trust model continues to serve as a blueprint for those seeking to build and protect generational wealth.

Key Takeaway: Establishing well-structured trusts is crucial. Trusts can provide ongoing management of assets, reduce tax burdens, and protect wealth from creditors and legal challenges.

2. The Walton Family: The Power of Business Ownership

The Walton family, the founders of Walmart, have mastered the art of preserving wealth through business ownership. By keeping significant stakes in the family business and focusing on long-term growth, the Waltons have built one of the world’s largest fortunes. The key was not only in growing their business but in creating mechanisms to maintain control and pass ownership down to future generations.

Key Takeaway: If you own a business, consider strategies like family limited partnerships, holding companies, and trusts to maintain control and seamlessly transition ownership across generations.

3. The Kennedy Family: Diversification and Strategic Trusts

The Kennedys are another example of a family that has successfully preserved wealth across generations. Through diversified investments and the use of dynasty trusts, the Kennedys have protected their wealth from estate taxes while ensuring financial stability for future generations. Their use of diversified assets, including real estate and market investments, has helped them weather financial storms and maintain their fortune.

Key Takeaway: Diversification is essential. A mix of real estate, businesses, and other investments provides resilience, while strategic trusts can protect and grow wealth over time.

Key Strategies for Building Generational Wealth

1. Start with an Estate Plan:

The first step in building generational wealth is having a comprehensive estate plan. A well-drafted will, combined with revocable or irrevocable trusts, can ensure that your assets are distributed according to your wishes while minimizing tax liabilities.

2. Invest in Real Estate:

Real estate is a tried-and-true method of building wealth. Whether it’s rental properties, commercial investments, or family homes, real estate tends to appreciate over time and provides a reliable income stream.

3. Establish Trusts for Tax Efficiency:

Trusts are powerful tools for protecting wealth from taxes, creditors, and legal disputes. Dynasty trusts, which can last for generations, are particularly effective for preserving wealth while minimizing estate taxes.

4. Teach Financial Literacy:

Passing down wealth is not enough; you must also pass down the knowledge and values needed to manage that wealth. Financial literacy education is crucial for ensuring that future generations can responsibly manage the assets they inherit.

5. Plan for Business Succession:

If you own a business, it’s essential to have a succession plan in place. Whether you plan to pass the business down to family members or sell it, having a clear strategy will help preserve the value of your business.

How Schwartsman Law Group Can Help

At Schwartsman Law Group, we understand the complexities of building and preserving generational wealth. We work closely with clients to develop customized strategies that address their unique needs, from setting up trusts and estate plans to creating business succession plans and investment strategies. By leveraging the expertise of our team, you can take the steps necessary to protect your wealth and secure your family’s financial future.

Building generational wealth is about more than just accumulating assets; it’s about creating a financial legacy that stands the test of time. By learning from the strategies of the Rockefeller, Walton, and Kennedy families, and implementing tailored estate planning tools, you can create a foundation that provides for your loved ones for generations to come.

Reach out to Schwartsman Law Group today to start planning for your family’s financial future. With the right approach, your wealth can grow, protect, and benefit your family for generations – just like the Rockefellers and Waltons.